Understanding the OEKO-TEX Standard 100

OEKO-TEX STANDARD 100 assures textiles are free from harmful substances, benefiting both consumer health and ecological responsibility throughout production processes.

What is the OEKO-TEX Standard 100?

OEKO-TEX STANDARD 100 is a globally recognized certification system testing textile products for harmful substances – from raw materials to finished goods. It’s a crucial independent testing and certification system for the textile industry, ensuring textiles are safe for human health and environmentally friendly. The standard tests for a wide range of substances, including prohibited azo dyes, formaldehyde, pesticides, and heavy metals.

This certification provides consumers with confidence that the textiles they are purchasing have been rigorously tested and meet stringent criteria. It’s not just about the final product; the entire supply chain is considered, encompassing yarn production, weaving, and finishing. The mark signifies a commitment to responsible textile production and consumer safety, standing as a benchmark for textile safety worldwide.

The Importance of Certification

OEKO-TEX certification is paramount for building consumer trust and demonstrating a brand’s commitment to product safety and ecological responsibility. In a market increasingly focused on sustainability, the STANDARD 100 label provides a clear and verifiable assurance to customers. It differentiates products, signaling they’ve undergone rigorous testing for harmful substances, offering peace of mind regarding health and environmental impact.

Certification also benefits manufacturers by promoting transparency and accountability throughout their supply chains. It encourages responsible sourcing and production practices, ultimately contributing to a more sustainable textile industry. The label isn’t merely a marketing tool; it represents a dedication to high standards and a proactive approach to minimizing potential risks associated with textile production and use.

Impact of Washing on OEKO-TEX Certification

OEKO-TEX STANDARD 100 certification can be lost through professional or chemical alteration, including washing, impacting the product’s original tested status.

Loss of Certification After Washing

The OEKO-TEX STANDARD 100 certification isn’t a permanent guarantee against harmful substances reappearing. The standard explicitly states that certification is voided once a product undergoes professional physical or chemical treatment, and this crucially includes washing and dry cleaning processes. This means that while a garment begins certified, subsequent washing can compromise that status.

This isn’t to say washing is inherently detrimental, but rather that the original testing only applies to the unaltered state of the textile. Subsequent treatments introduce variables not covered by the initial certification. Therefore, maintaining the integrity of the OEKO-TEX label relies on adhering to careful washing guidelines to minimize potential impacts on the textile’s composition and any applied finishes.

Professional vs. Home Washing

While both professional and home washing can invalidate the OEKO-TEX STANDARD 100 certification, the degree of risk differs. Professional cleaning introduces a wider range of chemicals and processes, potentially impacting the textile’s integrity more significantly than typical home laundering. This is due to the stronger detergents and higher temperatures often employed in commercial settings.

However, even home washing, if not performed correctly, can compromise the certification. Using harsh detergents, high heat, or fabric softeners can alter the textile’s composition and potentially re-introduce harmful substances. Therefore, adhering to recommended washing instructions – cold water, mild detergent, and avoiding additives – is crucial for minimizing the risk of losing the OEKO-TEX assurance, regardless of where the washing occurs.

Optimal Washing Instructions for OEKO-TEX Certified Textiles

OEKO-TEX certified textiles thrive with cold water, mild detergents, and avoiding bleach and fabric softeners to preserve their safety and integrity.

Recommended Water Temperature

When caring for OEKO-TEX STANDARD 100 certified textiles, prioritizing lower water temperatures during washing is crucial for maintaining the integrity of the certification and the fabric itself. Experts consistently recommend washing these items in cold water, generally considered to be 30°C (86°F) or below. This cooler approach minimizes the risk of dye bleeding, fiber damage, and shrinkage, all of which can compromise the textile’s quality and potentially affect the presence of harmful substances over time.

Higher temperatures can accelerate the breakdown of certain finishes or treatments applied to achieve OEKO-TEX certification, potentially releasing residual chemicals. While some fabrics may tolerate warmer washes – up to 40°C (104°F) as indicated on care labels – consistently opting for cold water is the safest and most sustainable practice. This gentle method ensures the longevity of your textiles while upholding the stringent standards of OEKO-TEX.

Detergent Selection: Mild and Fragrance-Free

Choosing the right detergent is paramount when washing OEKO-TEX STANDARD 100 certified textiles. Harsh chemicals and strong fragrances found in conventional detergents can leave residues on fabrics, potentially irritating sensitive skin and diminishing the effectiveness of the OEKO-TEX certification over repeated washes. Therefore, a mild, fragrance-free detergent is strongly recommended.

These gentler formulations are designed to clean effectively without stripping fibers or leaving behind harmful substances. Look for detergents specifically labeled as hypoallergenic or for delicate fabrics. Avoid detergents containing enzymes, bleach, or optical brighteners, as these can compromise the textile’s integrity. Prioritizing a pH-neutral detergent further safeguards the fabric’s color and structure. By selecting a mild and fragrance-free option, you contribute to preserving both the quality of your textiles and the principles of OEKO-TEX.

Avoiding Fabric Softeners

Fabric softeners are generally discouraged when caring for OEKO-TEX STANDARD 100 certified textiles, despite their appeal for added softness. These products often contain chemicals that coat fabric fibers, reducing their breathability and potentially leaving a residue that can interfere with the OEKO-TEX certification’s protective qualities. These chemical coatings can also diminish the absorbency of towels and other absorbent fabrics.

Furthermore, fabric softeners can build up over time, making fabrics feel less soft and potentially attracting dirt. If you desire softer textiles, consider using dryer balls during the drying process as a natural alternative. These help to fluff fibers and reduce static cling without introducing harmful chemicals. Maintaining the integrity of the OEKO-TEX certification relies on avoiding additives that could compromise the textile’s purity and safety.

Bleach: A Definite No-No

When it comes to maintaining the integrity of OEKO-TEX STANDARD 100 certified textiles, bleach is strictly prohibited. Bleach, even in diluted forms, contains harsh chemicals that can irrevocably damage fabric fibers and, crucially, invalidate the OEKO-TEX certification. The strong oxidizing agents in bleach react negatively with the textile’s composition, potentially releasing harmful substances and compromising its safety profile.

Even color-safe bleaches can pose a risk, as they still contain chemicals that may interfere with the textile’s tested harmlessness. If stain removal is necessary, opt for gentler, OEKO-TEX-approved alternatives like oxygen-based stain removers or mild detergents specifically designed for delicate fabrics. Prioritizing gentle cleaning methods ensures the continued safety and reliability of your OEKO-TEX certified items, preserving their intended benefits;

Drying Guidelines to Maintain Certification

To preserve OEKO-TEX certification, avoid high-heat exposure during drying; instead, utilize low-heat methods or air drying whenever practically feasible.

Low-Heat Drying Methods

Maintaining the integrity of OEKO-TEX STANDARD 100 certification hinges on careful drying practices. Opting for low-heat settings on your dryer significantly minimizes the risk of damaging the textile fibers and potentially releasing any residual substances. This gentle approach preserves the fabric’s structure and ensures the continued safety of the garment.

Air drying remains the most recommended method, as it eliminates heat exposure altogether. Laying the textile flat or hanging it on a clothesline allows for natural evaporation, preserving both the fabric and the certification. If a dryer is necessary, always check the care label for specific temperature recommendations. Remember, excessive heat can compromise the textile’s composition and potentially invalidate the OEKO-TEX certification, diminishing the assurance of harmlessness.

Avoiding High-Heat Exposure

Protecting your OEKO-TEX STANDARD 100 certified textiles requires diligent avoidance of high-heat exposure during drying. Elevated temperatures can break down fabric structures and potentially release any trace substances, compromising the certification’s guarantee of safety. This is particularly crucial for delicate fabrics or those with special finishes.

Steer clear of hot dryer settings and prolonged sun exposure, as both can inflict significant damage. Instead, prioritize low-heat options or, ideally, air drying. High heat can also cause shrinkage and color fading, diminishing the garment’s overall quality. Remember, the OEKO-TEX label signifies a commitment to textile safety, and maintaining that standard necessitates careful handling throughout the product’s lifecycle, with heat control being paramount.

Decoding Textile Care Symbols on Labels

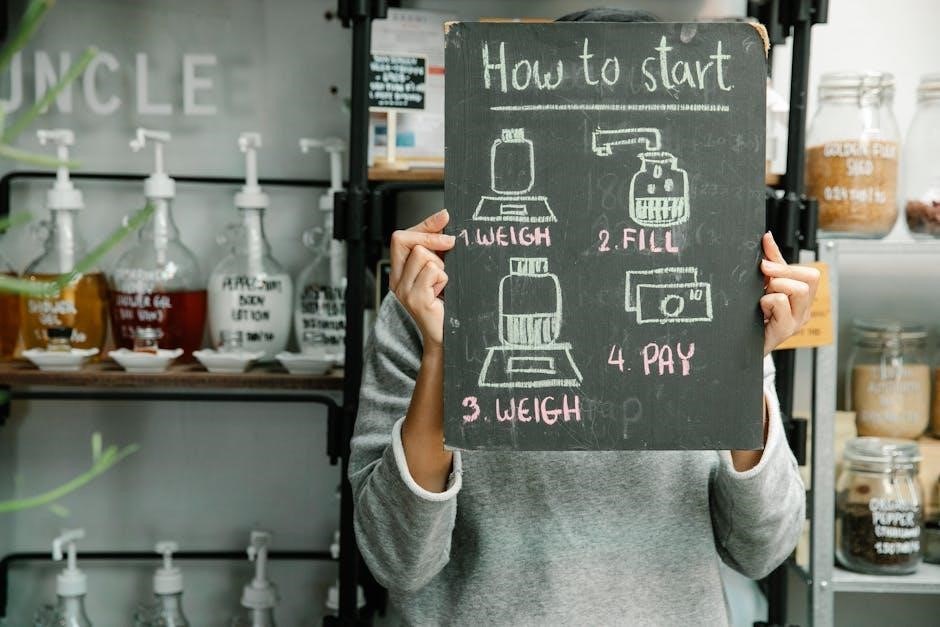

OEKO-TEX textiles utilize standardized care symbols – washing, bleaching, drying, and ironing – to guide consumers in maintaining product safety and longevity.

The Washing Symbol (Wash Tub)

The washing symbol, depicted as a wash tub, communicates crucial information regarding appropriate washing methods for OEKO-TEX certified textiles. A tub with a number inside indicates the maximum water temperature, typically in Celsius. For optimal preservation of the certification and textile integrity, a lower temperature – ideally cold water – is recommended.

Lines underneath the tub signify the wash cycle intensity; more lines indicate a more delicate cycle. A hand in the tub denotes hand washing only. It’s vital to adhere to these guidelines, as professional or home washing exceeding recommended parameters can compromise the textile’s safety profile and potentially invalidate the OEKO-TEX STANDARD 100 certification. Always prioritize gentle cycles and cooler temperatures to maintain the fabric’s quality and the assurance of being free from harmful substances.

The Bleaching Symbol

The bleaching symbol on a textile care label provides essential guidance regarding the use of bleaching agents. Represented by a triangle, this symbol dictates whether bleaching is permissible and, if so, what type. A plain triangle signifies that any bleaching agent can be used safely. However, a triangle with two diagonal lines indicates a strict prohibition against all bleaching products.

For OEKO-TEX STANDARD 100 certified textiles, the recommendation is overwhelmingly to avoid bleach entirely. Bleach, even in diluted forms, can compromise the fabric’s composition and potentially introduce harmful residues, negating the benefits of the certification. Adhering to the “no bleach” instruction ensures the continued safety and integrity of the textile, maintaining its status as free from harmful substances throughout its lifecycle. Prioritizing gentle cleaning alternatives is crucial;

The Dryer Symbol

The dryer symbol, depicted as a square, communicates the appropriate method for drying textile items. A circle within the square indicates tumble drying is allowed, while a crossed-out square signifies that tumble drying is prohibited. Lines within the symbol further refine the instructions, indicating the heat level – one line for low heat, two for medium, and three for high.

Maintaining OEKO-TEX STANDARD 100 certification necessitates careful consideration of drying methods. High-heat exposure can potentially damage the fabric and, more importantly, may compromise the integrity of the harmless substance guarantee. Therefore, it’s generally advised to avoid high-heat tumble drying. Opting for low-heat settings or air drying is preferable to preserve the textile’s safety and quality. Following these guidelines ensures the continued validity of the certification.

The Ironing Symbol

The ironing symbol, resembling an iron, provides guidance on the appropriate ironing temperature for textile care. Dots within the iron indicate the heat level: one dot signifies low heat, two dots represent medium heat, and three dots denote high heat. A crossed-out iron symbol indicates that ironing should be avoided altogether to prevent damage to the fabric or its finishes.

When caring for OEKO-TEX STANDARD 100 certified textiles, adhering to the ironing symbol’s instructions is crucial. Excessive heat can potentially degrade certain fibers or compromise the harmless substance guarantee. Generally, a low-temperature setting is recommended to maintain the textile’s integrity and preserve the certification. Always test a small, inconspicuous area first. Following these guidelines ensures the longevity and safety of your certified garments.

Care Label Materials and Assurance

OEKO-TEX certified care label materials guarantee safety and sustainability, complementing the textile’s certification and providing reliable washing guidance.

OEKO-TEX Certified Care Label Materials

Utilizing OEKO-TEX certified materials for care labels is crucial for maintaining the integrity of the STANDARD 100 certification and reinforcing a commitment to ecological responsibility. These labels, themselves tested for harmful substances, ensure that all components of a garment – from the fabric to the label – meet stringent safety criteria. This holistic approach builds consumer trust and demonstrates a dedication to transparency throughout the supply chain.

Sourcing certified labels signifies a commitment to avoiding potentially harmful chemicals in every aspect of textile production. They are suitable for sustainable collections, organic fashion, and any brand prioritizing environmental and human health. These materials are available from suppliers offering quantities starting from as little as 20 pieces, making them accessible for both large-scale manufacturers and smaller, independent designers.

Minimum Order Quantities for Labels

Fortunately, accessing OEKO-TEX certified care label materials doesn’t necessitate massive production runs. Suppliers recognize the needs of diverse businesses, including smaller, sustainable brands and independent designers. Consequently, minimum order quantities (MOQs) are often surprisingly accessible, frequently starting from just 20 pieces. This low threshold allows brands to incorporate certified labels into their collections without substantial upfront investment or inventory commitments.

This accessibility is particularly beneficial for those launching new lines or focusing on limited-edition designs. It enables a consistent application of the STANDARD 100 commitment across all products, regardless of volume; Choosing suppliers offering low MOQs streamlines the process and supports a wider adoption of responsible textile practices within the industry.

Maintaining OEKO-TEX Standards Throughout the Product Lifecycle

OEKO-TEX certification extends from initial yarn selection to the final product, ensuring consistent safety and ecological responsibility at every manufacturing stage.

From Yarn to Finished Product

The OEKO-TEX STANDARD 100 certification rigorously assesses every stage of textile production, beginning with the raw materials like yarns and fibers. This comprehensive evaluation extends through fabric production, weaving, and knitting processes, ensuring no harmful substances are introduced. Dyeing and finishing treatments are also scrutinized, verifying compliance with stringent chemical limits. Accessories, such as buttons, zippers, and prints, are equally tested to guarantee the final textile article is safe for human health.

This holistic approach means that even seemingly minor components cannot compromise the overall certification. Manufacturers must demonstrate consistent adherence to these standards throughout their entire supply chain, providing detailed documentation and undergoing regular audits. The goal is to deliver textiles that are not only aesthetically pleasing but also demonstrably safe and environmentally sound, from the very beginning to the finished product consumers use.

Rules and Guidelines for Usage of the STANDARD 100 Mark

The OEKO-TEX STANDARD 100 mark signifies a product has been rigorously tested for harmful substances, but its usage is governed by strict rules. The mark can only be applied to textile products or accessories that have successfully completed the certification process. Any professional alteration – including washing and chemical cleaning – immediately voids the right to display the mark.

Manufacturers must adhere to specific guidelines regarding the mark’s size, placement, and accompanying information on care labels. Misuse or unauthorized application is prohibited and can lead to legal consequences. The mark’s integrity is paramount, ensuring consumers can confidently rely on its representation of textile safety. Regular monitoring and audits are conducted to enforce these rules and maintain the STANDARD 100’s credibility.